are car loan interest payments tax deductible

Experts agree that auto loan interest charges arent inherently deductible. Reporting the interest from these loans as a tax deduction is fairly straightforward.

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

Answered on Dec 03 2021.

. This means you can deduct some of the cars value from the profits of your business before paying tax. Interest paid on personal loans is not tax deductible. Should you use your car for work and youre an employee you cant write off any of the interest you pay on your auto loan.

Click on Edit to the right of the business name. To the right of the Vehicle expenses click Edit. But if you own your business or youre self-employed its a different story.

The Section 179 Business Deduction. Of course there is a caveat and its why most people cant use their loan payments as a tax deduction. Interest paid on a loan to purchase a car for personal use.

As a result the interest payments could qualify for the student loan interest deduction and you may be able to deduct all the interest you paid for the year. If the car is used for a schedule C self-employment business there are two ways of deducting your vehicle. If a personal loan is being used for mixed purposes like a car loan with the car split between business and personal use then the portion of the interest thats deductible is proportional.

Tax Consequences Loan proceeds are not considered taxable income but you generally cant deduct interest you pay on a life insurance policy loan from your Insurance. To deduct interest on passenger vehicle loans take the lesser amount of either. For tax purposes a van is within the category of plant or machinery.

If you borrow to buy a car for personal use or to cover other personal expenses the interest you pay on that loan does not. You cannot deduct the actual car operating costs if you choose the standard mileage rate. The primary deduction difference between the purchase or lease of the vehicle is the amount of taxes you pay.

But there is one exception to this rule. For vehicles purchased between December 31 1996. This is true whether the.

This will therefore reduce your. Points if youre a seller service charges. Common deductible interest includes that incurred by mortgages.

When you purchase a vehicle you typically pay tax on the vehicle up-front. Unfortunately car loan interest isnt deductible for all taxpayers. If you use your car for business purposes you may be allowed to partially deduct car loan interest as.

This is true for bank and credit union loans car loans credit card debt lines of. If your business buys a vehicle for commercial use you can write off the total expense through the Section 179 deduction rules. You actually should be able to.

If you use a van regularly for your private use you can claim assessable van benefit which is currently. You may claim the cost of a car as a capital allowance. As a general matter personal loans do not carry deductible interest whether they are installment loans or lines of credit.

In order to do this your vehicle needs to fit into one of these IRS. Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer 11. 10 x the number of days for which interest was payable.

Typically deducting car loan interest is not allowed. Interest paid on personal loans is not tax deductible. The interest you pay on student loans and mortgage loans is tax-deductible.

Credit card and installment interest incurred for personal expenses. Not all interest is tax-deductible including that which is associated with credit cards and auto loans. Interest on a personal loan other than a home mortgage is never deductible.

Car loan interest is tax deductible if its a business vehicle. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre paying on a car loan. Business Loans In most cases the interest you pay on your business loan is tax deductible.

However there are exceptions to that rule ie a. The standard mileage rate already. Under Your income click on EditAdd to the right of Self-employment income.

Explore Our Image Of Car Payment Schedule Template For Free Car Payment Calculator Car Payment Car Loans

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Car Loan Payment Deferrals Loans Canada

How To Buy A Car Under A Business Name Car Buying Business Names Business

10 Things You Should Never Deduct From Your Taxes All Time Lists Best Car Insurance Car Insurance Online Cheap Car Insurance

What Is The Average Car Loan Interest Rate In Canada Loans Canada

Deduction Under Section 80 Eeb Of Income Tax Act Online Taxes File Taxes Online Income Tax

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Car Donation Tax Deduction Simplified Http Www Irstaxapp Com Car Donation Tax Deduction Simplified Donate Car Donation Tax Deduction Tax Credits

Car Loan Tax Benefits On Car Loan How To Claim Youtube

Shopping For A New Car Want A Better Idea Of What You Ll Be Paying For Your New Car Every Month Use Our Auto Loa Car Loan Calculator Car Loans Car Buying

Union Budget 2020 On Home Loan Tax Benefits Home Loans Loan Tax Deductions

All About Mileage June 1 2018 Levesque Associates Inc Mileage Small Business Owner Business Owner

Mortgage Affordability Tax Benefits Payoff Strategies Mortgage Mortgage Interest Rates Debt To Income Ratio

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Used Car Loan Car Loans Used Cars Loan

Is Car Loan Interest Tax Deductible In Canada

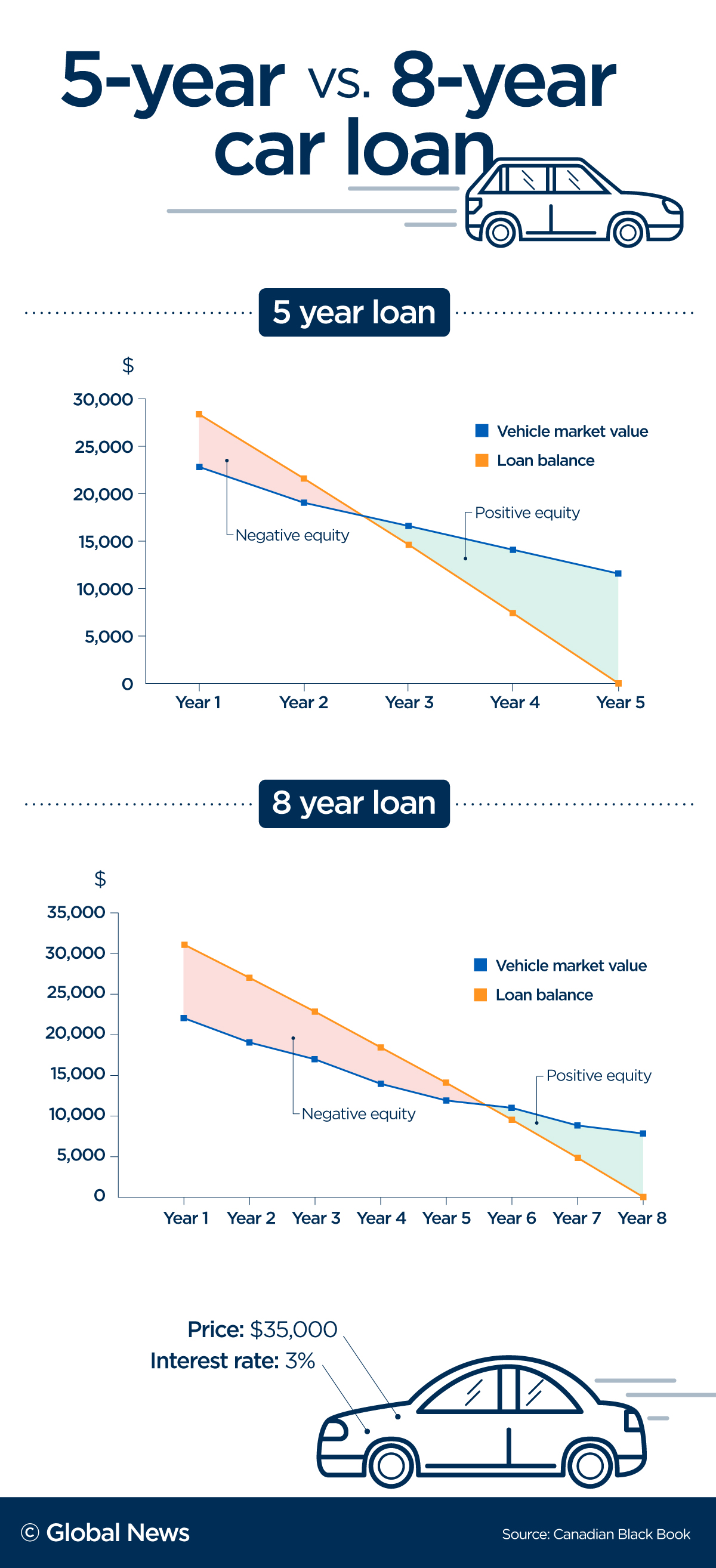

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca