idaho sales tax rate 2021

Federal excise tax rates on various motor fuel products are as follows. The Boise Sales Tax is collected by the merchant on all qualifying.

Lower tax rates tax rebate.

. Did South Dakota v. Download all Idaho sales tax rates by zip code. Remember that zip code boundaries dont always match up with political.

The Rexburg Idaho sales tax rate of 6 applies to the following three zip codes. Indiana Mississippi Rhode Island and Tennessee. Instructions are in a separate file.

2021 State Sales Tax Rates. 83440 83441 and 83460. For individual income tax rates now range from 1 to 65 and the number of tax brackets dropped from seven to five.

Find your Idaho combined state and local tax rate. 278 rows 2022 List of Idaho Local Sales Tax Rates. The minimum combined 2022 sales tax rate for Idaho City Idaho is 6.

Accuracy cannot be guaranteed at all times. Wayfair Inc affect Idaho. The Idaho sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the ID state sales tax.

Thats why we came up with this handy Idaho sales tax. The Idaho sales tax rate is currently. Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9.

Idaho sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Plus 1125 of the amount over. ID Combined State Local Sales Tax Rate avg 604.

Object Moved This document may be found here. An alternative sales tax rate of 6 applies in the tax region Madison which appertains to zip codes 83440 and 83441. 31 rows Idaho ID Sales Tax Rates by City.

Single under age 65. Exemptions to the Idaho sales tax will vary by state. While many other states allow counties and other localities to collect a local option sales tax Idaho does not permit local sales taxes to be collected.

Single age 65 or older. ID State Sales Tax Rate. The Boise sales tax rate is.

The Stanley sales tax rate is. Look up 2021 sales tax rates for Mesa Idaho and surrounding areas. The Boise Idaho sales tax is 600 the same as the Idaho state sales tax.

Sales tax rates are subject to change periodically. Plus 3125 of the amount over. The Rexburg Idaho sales tax is 600 the same as the Idaho state sales tax.

This is the total of state county and city sales tax rates. Did South Dakota v. The minimum combined 2022 sales tax rate for Boise Idaho is.

The lowest non-zero state-level sales tax is in Colorado which has a rate of 29 percent. The County sales tax rate is. Plus 4625 of the amount over.

The price of all motor fuel sold in Idaho also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration. The Idaho sales tax rate is currently. The Idaho sales tax rate is currently 6.

Lowest sales tax 6 Highest sales tax 9 Idaho Sales Tax. Download all Idaho sales tax rates by zip code. The Rexburg Sales Tax is collected by the merchant on all.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Form 40 is the Idaho income tax return for Idaho residents. This is the total of state county and city sales tax rates.

The state sales tax rate in Idaho is. The Idaho Falls sales tax rate is. Idahos income tax rates have been reduced.

Wayfair Inc affect Idaho. The minimum combined 2022 sales tax rate for Stanley Idaho is. Tax Rate.

This is the total of state county and city sales tax rates. Idaho businesses charge sales tax on most purchases. Plus 5625 of the amount over.

House Bill 317 Effective January 1 2021. The Idaho City sales tax rate is 0. The County sales tax rate is.

There are approximately 19264 people living in the Rexburg area. The County sales tax rate is 0. 2 Four states tie for the second-highest statewide rate at 7 percent.

What is the sales tax rate in Idaho City Idaho. This is the total of state county and city sales tax rates. Also some Idaho residents will receive a one-time tax rebate in 2021.

We strongly recommend using a sales tax calculator to determine the exact sales tax amount for your location. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3. The base state sales tax rate in Idaho is 6.

Plus 6625 of the amount over. The corporate income tax rate is now 65. Tax rates are provided by Avalara and updated monthly.

The sales tax rate in the state is 6 percent which ranks Idaho as 17th on the list of 50 states with the highest sales tax. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. Did South Dakota v.

Idaho sales tax rate. The Idaho sales tax rate is currently. California has the highest state-level sales tax rate at 725 percent.

Idaho residents must file if their gross income for 2021 is at least. While many other states allow counties and other localities to collect a local option sales tax Idaho does not permit local sales taxes to be collected. Married filing separately.

What is the sales tax rate in Idaho Falls Idaho. Average Sales Tax With Local. 2021 Idaho State Sales Tax Rates The list below details the localities in Idaho with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

The minimum combined 2022 sales tax rate for Idaho Falls Idaho is. The County sales tax rate is. Plus 3625 of the amount over.

How High Are Cell Phone Taxes In Your State Tax Foundation

Utah Sales Tax Small Business Guide Truic

Claim Your Grocery Credit Refund Even If You Don T Earn Enough To File Income Taxes Idaho Bigcountrynewsconnection Com

Idaho Tax Forms And Instructions For 2021 Form 40

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

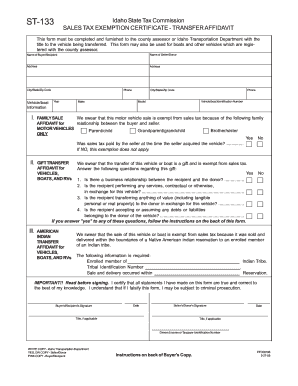

Idaho Sales Tax Fill Online Printable Fillable Blank Pdffiller

Idaho Income Tax Brackets 2020

How Is Tax Liability Calculated Common Tax Questions Answered

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Where S My Idaho State Tax Refund Taxact Blog

Idaho Residents Start Seeing Tax Relief Money

Idaho S Grocery Sales Tax Is An Issue At Every Legislative Session Have Thoughts Let S Talk Idaho Capital Sun

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun